Strategic market and legal risks

We operate in a volatile global market, where price volatility is influenced by a range of factors at the national, European and global level. Thus, one of the strategic risks we see is a fall in the oil sales price below a critical threshold in the context of a general fall in the price of petroleum. The sale of shale oil makes up 2/3 of the Group’s net turnover, so the risk of changes in the market prices of petroleum and petroleum products is an inevitable part of the Group’s activities. The majority of the sales contracts of VKG Oil AS have been concluded on the condition that the sales price of products is directly linked to the stock market prices of petroleum products. The other part is indirectly dependent on world market prices. The sales price of shale oil may fall as a result of both a drop in the world market price of petroleum and the depreciation of the dollar.

Reasons for the rating of the risk:

The price of petroleum and petroleum products is very volatile, as even a small imbalance in production and consumption causes extensive rises and falls in prices. For instance, the average Brent Front Month price was:

Another important strategy risk is related to the fall in the volume of free CO2 quotas after 2025 and the rapid increase in the price of the quotas.

The shale oil industry is a part of the EU’s petroleum refining and carbon leakage sector which is allocated free CO2 quotas. The fourth greenhouse gas (GHG) trading period of 2021–2030 is divided into two parts: 2021–2025 and 2026–2030. The trading rules and the methods for allocating free CO2 quotas are currently known until 2025. Decisions to be taken by the European Parliament and the Commission in the course of the Green Transition will play an important role in ensuring the Group’s economic activities and competitiveness, as they could significantly reduce the amount of free CO2 quotas allocated to shale oil production and increase the purchase price of the quotas.

An extensive increase in the price of CO2 quotas and/or a reduction of the free quotas will cause a great additional tax burden for oil production, making the production price of oil higher than its market price and thus rendering the business uncompetitive.

The CO2 tax rate has risen over 10 times since 2017 and the proportion of VKG’s taxable emissions has risen to 20% of all the emissions. The entailing CO2 tax burden has grown to 20 million euros a year. Considering the EU’s green policy, there is a risk that local production may go extinct as a result of carbon taxes. As the rules are in place until 2025 and the price of the quotas has recently been rather stable, the probability of major problems in the nearest two years is rather low than high.

Next, we map the risk of continuity of supply of raw material which would cause a stop in activities and the inability to fulfil contractual obligations.

The risk may materialise in two parts: a lack of crushed stone may halt the operation of the Kiviter plants. The suspension of the operation of the Ojamaa Mine may very strongly disrupt or halt all the production activities of VKG Oil.

We have also mapped the possible risk of damage to reputation which may arise in connection with environmental pollution, low salaries, the establishment of new plants/mines, accidents happening in our territory, violations of standards of ethics, and other such.

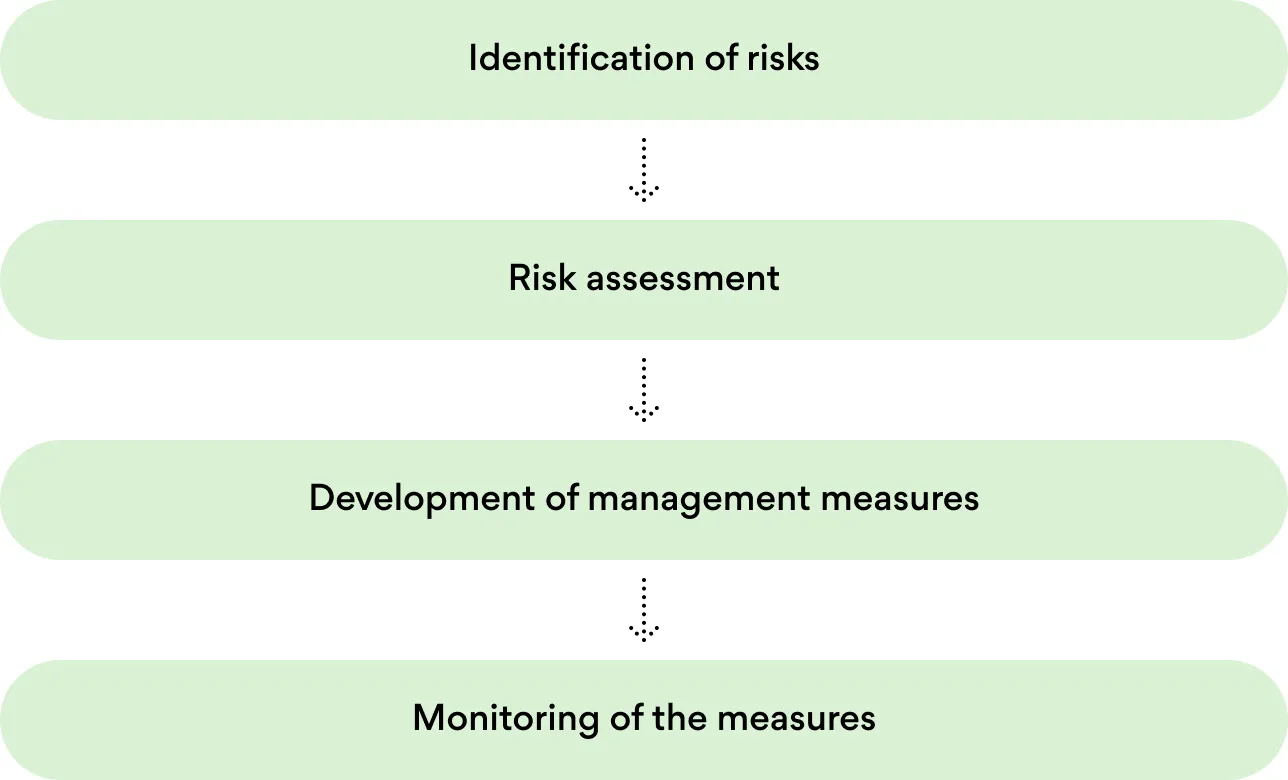

Operating risks

Operating risks stem from deficient or ineffective processes and systems as well as the insufficient competences or activities of people in managing the work processes. In order to avoid operating risks, the Group has developed risk management principles, various standards and management systems. We understand operating risks to include technological and IT risks as well as operating risks related to the external environment, such as those related to clients and suppliers.

We pay great attention to risks related to occupational safety and the working environment. All the Group enterprises have implemented respective systems for managing and monitoring activities. We handle occupational safety risks on the principle that prevention is more important than dealing with consequences. The Group implements a system for registering dangerous situations, which is accessible to all the employees, partners and visitors to the production territory. An in-depth analysis of registered dangerous situations and the timely elimination of threats has prevented several potential work accidents.

Under financial risks, we have mapped a currency risk with regard to the euro and dollar rate. The Group’s cost base is in euros, but the entire oil production is sold in dollars, which entails a considerable currency risk:

- the higher price of petroleum, the greater the effect of changes in the dollar rate and vice versa, the lower the price of petroleum, the smaller the effect of changes in the dollar rate;

- the weakening of the dollar together with a decrease in the price of petroleum deepens the decrease of our revenue.

We also assign a high rating to compliance risks, e.g. failure to obtain or delays in obtaining mining permits, a decrease in the availability of raw material due to changing regulations. The regulation of mining permits is strict and does not keep up with the actual extraction volumes of the market participants. Overbooking resources is not disapproved. The topicality of the Green Deal may cause legislative and public pressure to end mining.

Our special focus is on the management of the risk of fraud. In order to reduce the threat of the risk of fraud and theft materialising and causing damage, we primarily apply preventive measures and increase efficiency. We regularly conduct random inspections and improve the transparency of processes, paying great attention to the speed of detecting fraud and responding to it. Our focus is on everyday work in informing our employees and encouraging them to provide constant feedback for which we have created a number of operative channels.